colorado estate tax threshold

Inheritance Tax threshold should be doubled poll shows from wwwexpresscouk. The deadline to file a 2022 Exempt Property Report is April 15 2022.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

From Fisher Investments 40 years managing money and helping thousands of families.

. To qualify for a small estate probate in Colorado the estate must not contain any real property ie. The Estate Tax is a tax on your right to transfer property at your death. May increase with cost of living adjustments.

However under certain circumstances involving fiscal year state revenues in excess of limitations established in the state constitution the income tax rate for future tax years may be temporarily reduced to 45. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. For 2021 this amount is 117 million or 234 million for married couples.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. Land homes buildings etc and the decedents personal property must be less than 66000. For tax years 2022 and later the Colorado income tax rate is set at 455.

A federal estate tax return can be. 13 rows Even though there is no estate tax in Colorado you may still owe the federal estate tax. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment.

In Colorado youll pay capital gains taxes at the same rate you pay on your general income. The estate tax is a tax on a persons assets after death. Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return.

Currently businesses dont have to pay personal property tax if the personal property is worth less than 7900. Land homes buildings etc and the decedents personal property must be less than 66000. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein.

With a small estate probate assets can simply be collected by obtaining what is called a small estate affidavit. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. This is 463 percent putting it on the lower end of.

You first calculate your taxable estate value apply the graduated estate tax rates to arrive at a tentative us. EITC is available for lower-income households currently the limits are about 21000 for a single filer or 54000 for a family with two. The answer is undoubtedly because it is cheaper and quicker.

However not many states have an estate tax. If you have not received an annual report and instructions by postal mail by March 15 2022 please contact Exemptions at 303-864-7780 and provide your file number see previous years form and updated mailing address. For 2020 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 1158 million.

Estate tax can be applied at both the federal and state level. Land homes buildings etc and the decedents personal property must be less than 66000. Colorado has no estate tax for decedents whose date of death is on or after January 1 2005.

All retail sales are considered for the purpose of the 100000 threshold regardless of whether those sales would be subject to Colorado tax. No estate tax or inheritance tax Connecticut. But if its the decedent who has children from a past relationship the spouses share drops to the estates first 150000 and half the balance according to.

Businesses would see a big increase in the dollar threshold of personal property and equipment that is exempt from taxes. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDFThe fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. Colorado Estate Tax Threshold.

The state of Colorado for example does not levy its own estate tax. In 2021 federal estate tax generally applies to assets over 117 million. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

The federal credit for state death taxes table has a tax rate of 0 for the first 40000. The state of Colorado for example does not levy its own estate tax. Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as of the January 1 assessment date.

Federal exemption for deaths on or after January 1 2023. Forms are mailed by March 1. It taxes the entire amount of the estate on estates over that 1 million threshold.

Note however that the estate tax is only applied when assets exceed a given threshold. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. For this the first 225000 of the decedents estate goes to the spouse as well as half of the balance.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Retail Sales for rules for determining the location of a sale. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

House Bill 1312 raises that threshold to 50000.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

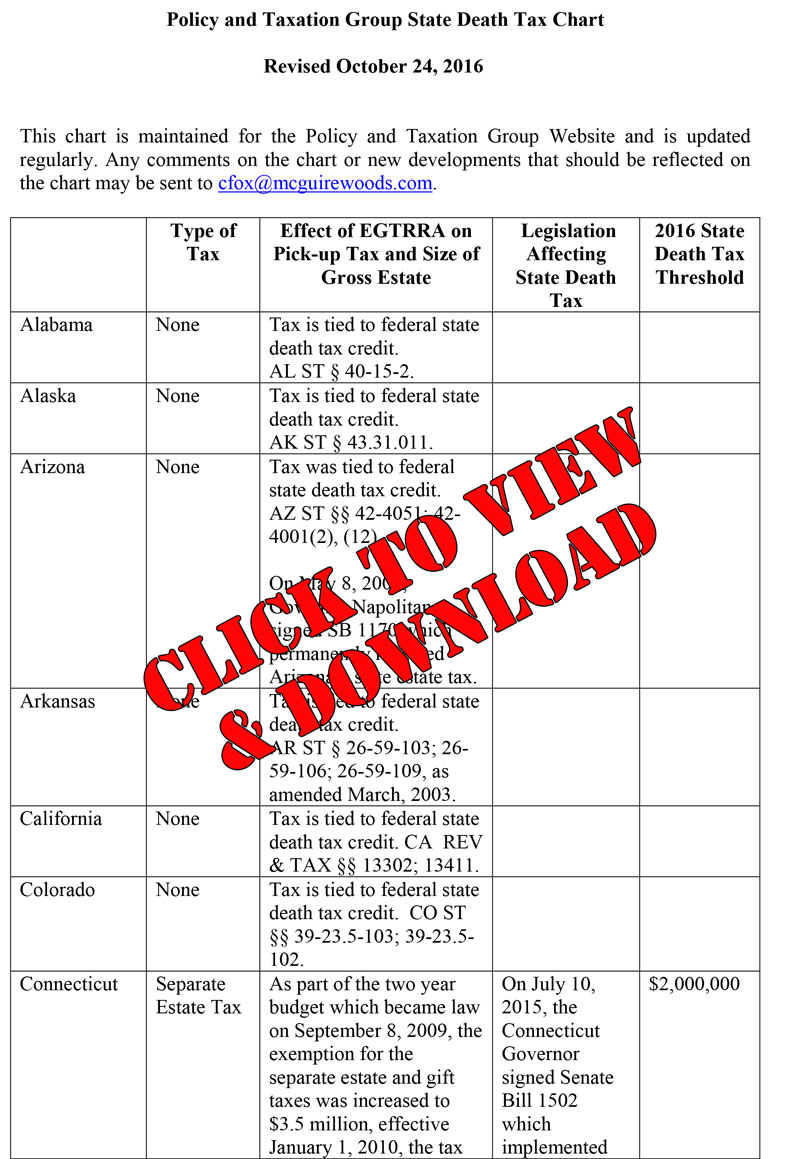

State Death Tax Family Enterprise Usa

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Everything You Need To Know Smartasset

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Estate Planning Update Helsell Fetterman

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered